Table of Content

The SBI Home Loan EMI Calculator tells you about the EMI value. It is dependent upon loan principal, loan term, and the rate of interest. Whereas the SBI Home Loan Eligibility Calculator tells you about the maximum amount of home loan the borrower is eligible for. It is dependent upon the income, job profile, age, and credit score of the applicant. Cost of Loan – In addition to the EMI value, SBI home loan interest rate 2022 EMI calculator also apprises the user of the total interest outflow on the home loan amount. As longer loan tenures have higher interest implications, the borrower can reduce the loan tenure or principal amount to reduce the loan cost.

Not entering the processing fee will not affect your results, but the other three inputs are mandatory to get precise results. Thus, EMI will be re-calculated using the outstanding loan principal. However, some lenders do not re-calculate the EMI but reduce the loan term.

State Bank Of India's Ifsc Codes

Easy Calculation - The mathematical formula of the Home Loan EMI Calculator is complex. The use of the SBI Bank home loan EMI calculator makes this calculation easy. All one needs is the information of the principal loan amount, rate of interest, and loan tenure.

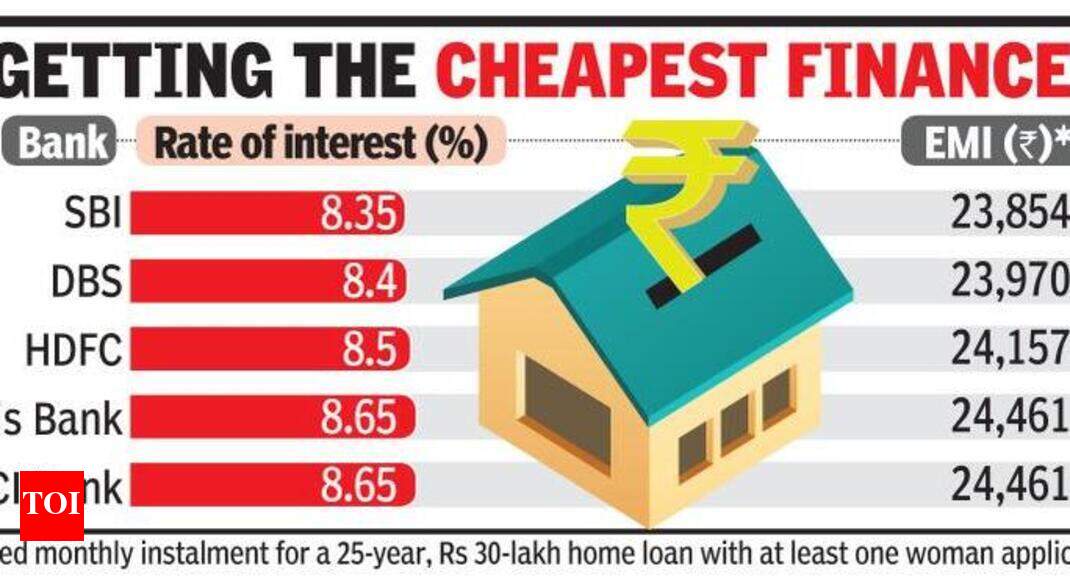

The Interest rate also significantly impacts the monthly EMIs. If the interest rate on the home loan increases, it will add to the EMI and ultimately escalate the loan cost. It is advisable to do meticulous research on the interest rates to avail yourself of the best offer. The SBI home loan calculator provides utmost clarity to the potential borrowers on their EMI payments.

Calculate SBI Home Loan EMI

No processing fee will also be levied by SBI on top-up and regular home loans. Individuals must have a good CIBIL score to avail the offer. Just like other loans, home loans are also given based on the repayment capacity of the applicant. Since it is also a debt, SBI takes into account the salary or income of the applicant before deciding the loan amount. There is also a facility to calculate the eligibility for a home or housing loan.

Note your monthly expenses, liabilities, and other financial obligations, including ongoing EMIs. Here we have illustrated the EMI on SBI home loan of Rs. 1 lakh @8.75% across different tenures. Below given is the housing loan information by State Bank of India.

SBI Home Loan EMI Calculator Formula

The bank has also raised the base rate by similar basis points to 8.7 per cent. According to the latest update on the SBI website, these changes will take effect from 15 December 2022. SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST. The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. Pradhan Mantri Awas Yojana can help you save money on your first house. Under the scheme, you can get subsidy of up to Rs.2.67 lakh.

The rest of the country can avail of this offer on home loans in the bracket of 30 Lakhs and 2 crores. The calculator is based on a mathematical formula that provides you with an approximate figure that you may use as a reference point. This eliminates significant inaccuracies that might arise from manual calculations, which tend to be extremely time-consuming and inefficient. N is the number of years for which the loan has been taken.

With a loan EMI calculator, you can prepare yourself in advance for the future payments and manage the finances accordingly. Also, you can use it as many times as you want not only before applying for a home loan, but even during the loan to know how much you have paid and how much you is left to pay. Home loans are long-term and secured financing options available for constructing or purchasing a property. In recent years, home loans have seen a considerable rise, one of the primary factors for which is the Pradhan Mantri Awas Yojana .

Borrowers with a credit score of 750 to 799 will have to pay a 7.65% interest rate with a risk premium of 10 basis points. SBI has increased the marginal cost of fund-based lending rates by up to 0.10% effective from 15 July 2022. Before taking a home loan from SBI, it’d be a good idea to check whether you will be able to pay the monthly instalments. The easiest way to do this is to use Home Loan Calculator. Just enter the proposed loan amount, the tenure of the loan, the interest rate the bank is offering you, and the processing fee.

As you repay the loan with interest, the proportion of principal repayment will increase, and interest component will reduce. However, each month, the principal repaid and interest payment proportion will be different in every EMI. A unique feature represented by the EMI calculator is its variety. No matter which type of loan one is availing, this tool calculates it all. Does SBI home loan take the salary of the spouse into consideration? The interest rates mentioned in the table above are based on CIBIL score.

In fact, long hours of manual calculations can prove both inaccurate and time-consuming. SBI loan EMI calculator enables borrowers to remove all confusion while focusing on how much to pay and at what time. Yes, SBI does give pre-approved home loans for which you can contact the bank for more details. SBI interest rates are pegged to floating interest card rate which currently stands lowest at 8.55% p.a. You can repay your EMIs online with the help of Net banking.

Although you are required to have an online SBI account to avail of this option. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down.

SBI bank EMI calculator, users will get pictorial representations, which prove to be advantageous. Irrespective of place and time one can access this calculator and take charge of their financial decisions on the go. This section will help you know about some benefits of using an EMI calculator. SBI charges anywhere between 0.3% to 1% of the total loan amount as their fees. Let’s glance over the Loan Amortisation Schedule on a home loan of Rs 10,00,000 at a 7.05% interest rate to be paid in ten years.

You can avail an additional interest rate concession of five basis points when applied from the YONO mobile application of the SBI. Applicants would receive interest rate concessions of twenty basis points on loans up to Rs 3 crores. This offer is exclusive to the eight major cities of the country.

SBI is one of the reputed banks in India with more than 50 Crore customers in more than 25,000 branches. Whether it is deposits or loans, SBI ranks among the top in the list of banks and financial institutions in this country. SBI home loan EMI calculator, borrowers can calculate their monthly installments before applying. Amortisation Schedule - The SBI home loan EMI calculator provides the useful bifurcation of the principal amount and the interest component of the home loan. The amortisation schedule proves especially helpful during loan repayments.

No comments:

Post a Comment